Sending your first international transfer can feel daunting. What documents do you need? How long will it take? Is your money safe? This step-by-step guide walks you through everything, from choosing a transfer method to ensuring your recipient receives the funds smoothly. By the end, you’ll transfer money to India with confidence.

Step 1: Choose Your Transfer Method

You have several options for sending money to India. Online remittance services like Crobo, Wise, and Remitly offer the best combination of speed, cost, and convenience for most people. Bank wire transfers are expensive and slow but may be required for very large amounts. Mobile apps from Indian banks like ICICI’s Money2India work if you already have accounts with them. Cash transfer services like Western Union are useful for unbanked recipients but charge premium fees.

Step 2: Gather Required Information

Before starting, collect your recipient’s bank account number, IFSC code (11-character code identifying the bank branch), full name exactly as it appears on their bank account, phone number for transfer notifications, and address for compliance purposes. For the sender, you’ll need US government ID such as a passport, driver’s license, or state ID, a Social Security Number or ITIN, proof of address, and your bank account or debit card details.

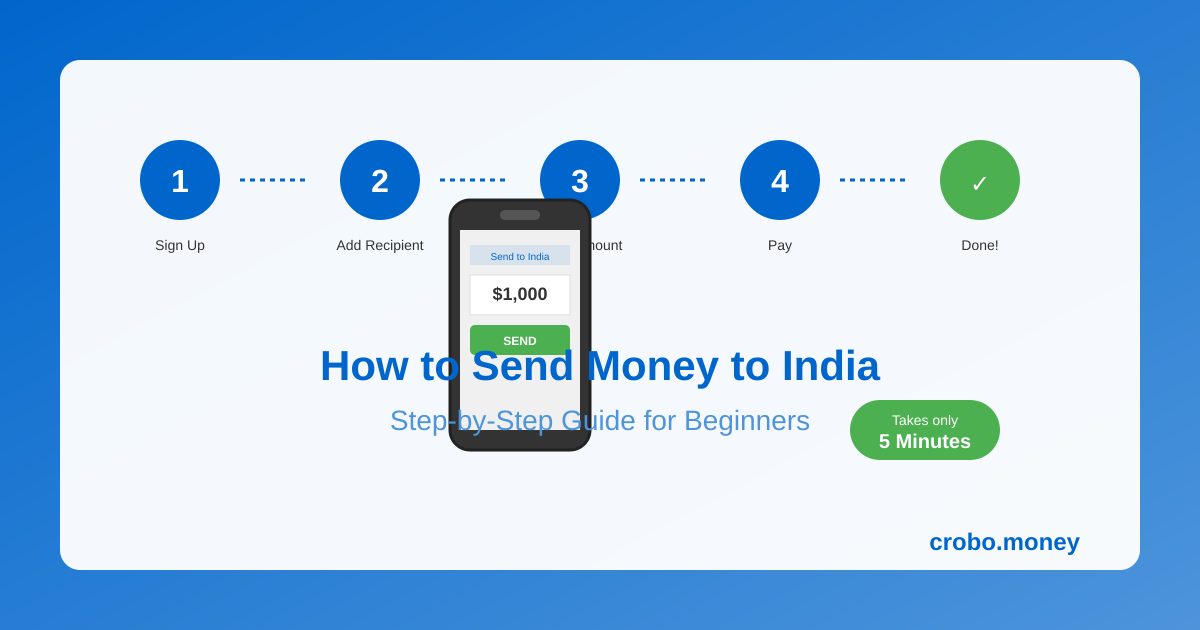

Step 3: Create Your Account

Using Crobo as an example, the process is straightforward. Download the Crobo app from the App Store or Google Play. Enter your email and create a password. Verify your identity by uploading a photo of your ID. Enter your SSN for regulatory compliance. Complete address verification. This one-time setup typically takes 5-10 minutes. Some services may require additional verification for larger transfers.

Step 4: Add Your Recipient

Enter your recipient’s details carefully since mistakes cause delays. Double-check the account number by having your recipient confirm from their bank statement or passbook. Verify the IFSC code matches their branch. Ensure the name matches their bank account exactly since “Raj Sharma” and “Rajesh Sharma” will cause problems. Save the recipient for future transfers.

Step 5: Enter Transfer Amount and Review

Enter the amount you want to send in USD. Review the exchange rate being offered and compare to the Google rate. Check the total fees applied. Confirm the amount your recipient will receive in INR. Look for any promotional offers for first-time users. Take a screenshot of this summary for your records.

Step 6: Fund Your Transfer

Select your payment method. ACH bank transfer is usually free but takes 2-4 business days to process. Debit cards process instantly but may have a small fee. Credit cards work but often have cash advance fees from your card issuer. Wire transfers are fastest but most expensive. For your first transfer, ACH is recommended to verify everything works smoothly.

Step 7: Track and Confirm

After submitting, you’ll receive a confirmation email with a reference number. Track your transfer status in the app since most services show stages like processing, in transit, and delivered. Your recipient should receive an SMS or email notification when funds are deposited. Have them confirm receipt and check the amount. Save all confirmation details for your records.

Tips for a Smooth First Transfer

Start with a smaller amount to test the process before sending larger sums. Inform your recipient to expect the transfer to avoid them missing notifications. Avoid weekends and Indian bank holidays for fastest processing. Keep your phone accessible for any verification codes. Save the customer support number in case of issues.

What If Something Goes Wrong?

If your transfer is delayed, first check the app for status updates. Contact customer support with your reference number. Common issues include bank holidays causing delays, incorrect recipient details requiring correction, and verification holds for first-time or large transfers. Reputable services like Crobo have guarantees where your money is refunded if the transfer fails.